Thailand’s economy stands as a beacon of opportunity in Southeast Asia. With its strategic location, robust infrastructure, and pro-investment policies, the Kingdom attracts entrepreneurs and corporations from across the globe. Yet, beneath this promise of growth lies a complex tapestry of regulatory frameworks, cultural nuances, and financial practices that can challenge even the most seasoned business leaders.

For foreign investors and local businesses alike, navigating this landscape requires more than just a good business idea—it demands expert guidance. This is where professional finance and business advisory services in Thailand become not just valuable, but essential. This guide explores how these services provide the strategic compass for sustainable success in the Thai market.

Why Thailand? The Opportunity and The Challenge

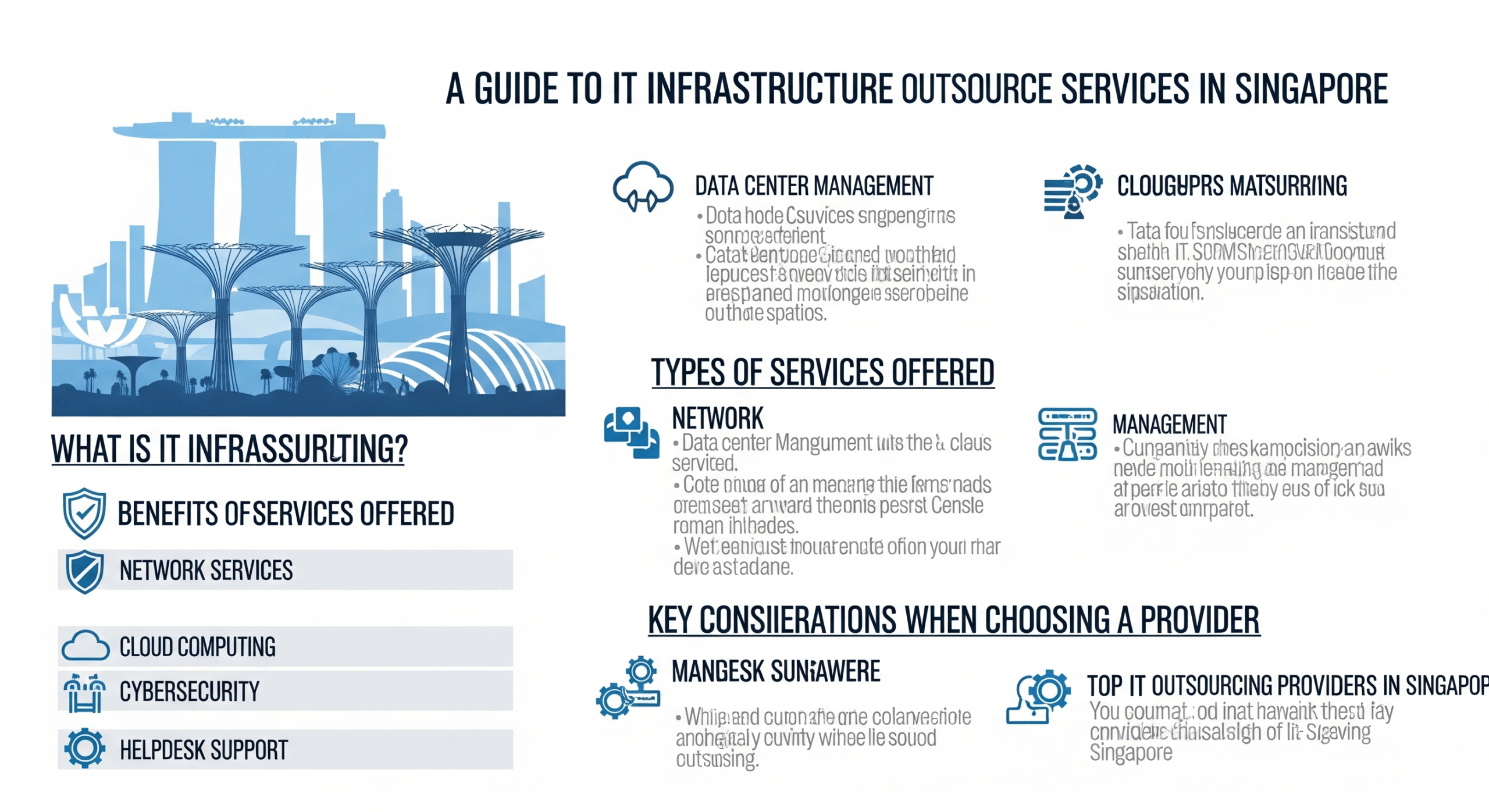

Thailand’s economic strengths are significant. As a regional hub for automotive manufacturing, tourism, digital technology, and agriculture, the country offers diverse avenues for investment. Government initiatives like the Thailand 4.0 policy and incentives from the Board of Investment (BOI) actively encourage foreign direct investment (FDI) in targeted sectors.

However, the path to success is paved with unique challenges. The Foreign Business Act (FBA) dictates specific industries where foreign ownership is restricted or prohibited. Understanding Thai Financial Reporting Standards (TFRS), complying with the Revenue Department’s tax regulations, and navigating cultural business etiquette are hurdles that can stymie growth without the right expertise.

Key Challenges Where an Advisor Becomes Invaluable

- Legal and Structural Complexity: Choosing the right business entity—whether a limited company, representative office, or branch—is a critical first step with long-term implications for ownership, liability, and tax treatment.

- Financial Compliance: Thailand’s accounting and reporting standards (TFRS) are rigorous. Ensuring accurate bookkeeping, payroll management, and timely financial reporting is mandatory and often complex for new market entrants.

- Tax Optimization and Strategy: From Corporate Income Tax and Value Added Tax (VAT) to Withholding Tax and Transfer Pricing regulations, the Thai tax system requires careful navigation to ensure compliance while optimizing liabilities.

- Cultural and Operational Navigation: Success in Thailand is often built on relationships and understanding local business customs. Missteps in negotiation, management style, or marketing can hinder progress.

Core Services Offered by Finance and Business Advisory Firms

A comprehensive advisory partner offers a suite of services designed to address these challenges holistically:

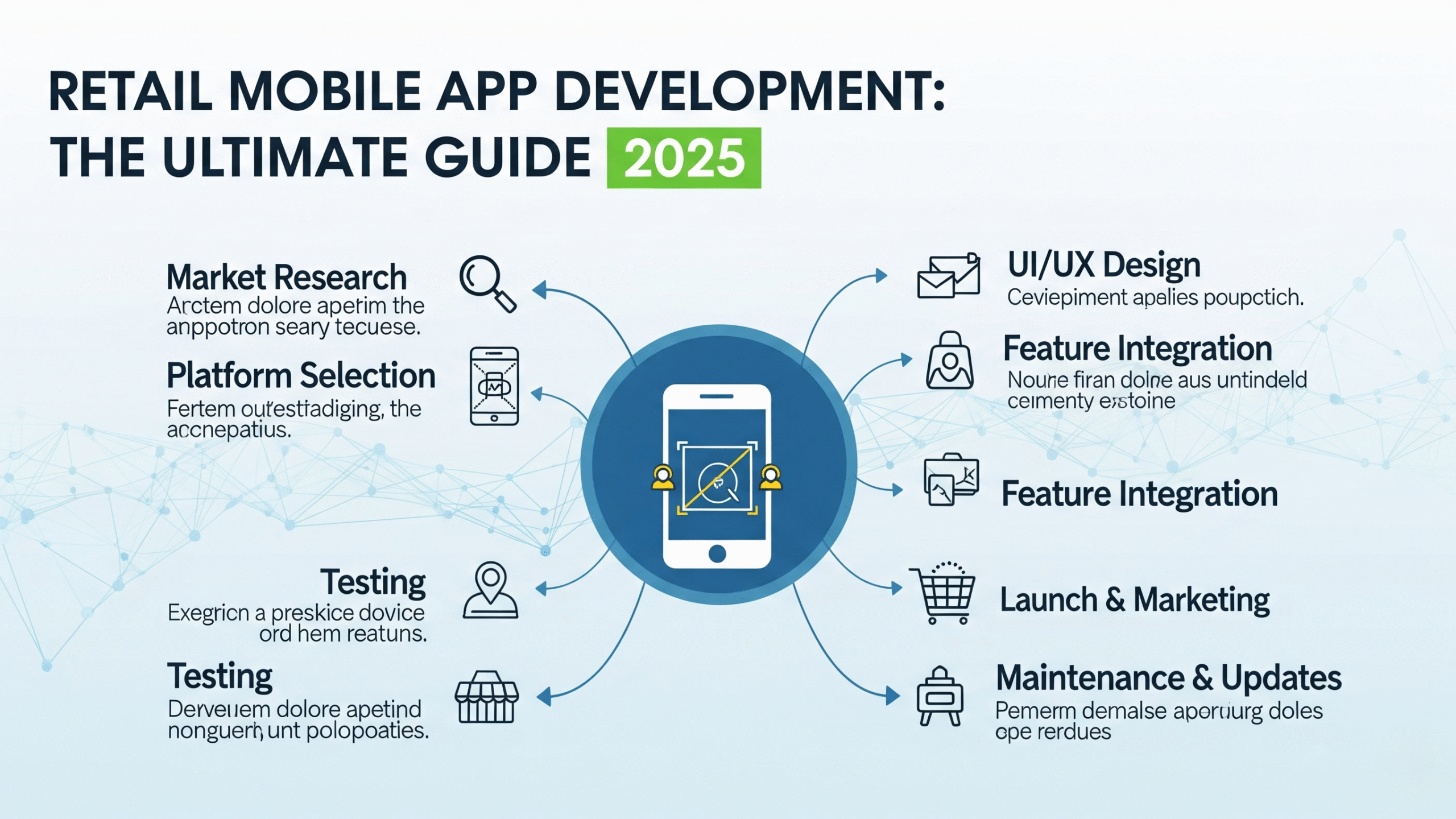

1. Market Entry and Business Setup Advisory

This is the foundational service. Advisors conduct feasibility studies, help select the optimal legal structure (including leveraging BOI promotions for eligible projects), and manage the entire company registration process. They ensure your business is established on a solid, compliant foundation from day one.

2. Financial Management and Outsourcing

Many firms offer outsourced finance functions. This includes everything from day-to-day bookkeeping and payroll processing to more strategic services like virtual CFO support. This provides businesses with expert financial oversight without the cost of a full-time, in-house team, ensuring ongoing compliance with TFRS.

3. Tax Advisory and Compliance

Tax advisors do more than just file returns. They provide strategic planning to help structure your operations tax-efficiently, prepare necessary documentation for Transfer Pricing, ensure VAT compliance, and represent you in communications with the Revenue Department, mitigating risks and identifying savings.

4. Corporate Finance and Investment Advisory

For businesses looking to scale, advisors offer critical support in financial modeling, fundraising, merger and acquisition (M&A) due diligence, and business valuation. They help you build a compelling case for investors and make informed strategic decisions.

5. Strategic Business Consulting

This broader service involves helping you refine your business model, conduct market research, develop growth strategies, and improve operational efficiency. Advisors act as strategic partners, providing the insights needed to adapt and thrive in the competitive Thai market.

The Unbeatable Advantage of a Local Partner

The true value of an advisory firm lies in its local expertise. A quality advisor brings:

- Regulatory Mastery: They possess up-to-the-minute knowledge of laws that frequently change.

- Established Networks: Strong relationships with government bodies, banks, and legal professionals can streamline processes.

- On-the-Ground Presence: Having a team physically located in Bangkok or key provinces means they can provide hands-on support and resolve issues quickly.

- Cultural Intelligence: They provide invaluable guidance on Thai business etiquette, helping you build trust and strong local partnerships.

Who Can Benefit?

Virtually any business can gain an edge with the right advisor:

- Tech Startups seeking BOI promotion and navigating rapid growth.

- Manufacturers setting up in industrial estates like the Eastern Economic Corridor (EEC).

- E-commerce and Retail brands adapting to Thai consumer behavior.

- Established SMEs looking to improve profitability or prepare for investment.

Conclusion

Entering and growing a business in Thailand is an exciting venture filled with potential. However, the complexities of the market mean that going it alone can be a risky strategy. Partnering with a seasoned finance and business advisory firm in Thailand is an investment in certainty. It provides the clarity, compliance, and strategic insight needed to mitigate risks, avoid costly mistakes, and ultimately, unlock the full potential of your business in the Land of Smiles.

The right advisor doesn’t just help you navigate the rules—they help you write your success story.

Ready to unlock your business potential in Thailand? Schedule a free, confidential consultation with our experts today. We’ll help you map out a clear strategy for confident market entry and sustainable growth.

Frequently Asked Questions (FAQ)

Q: What is the first step to starting a business in Thailand?

A: The first step is conducting thorough market research and seeking advisory services to determine the most suitable legal structure for your business goals. An advisor will help you understand if you qualify for BOI promotion or need a specific license based on the Foreign Business Act.

Q: How can a business advisor help with Thai tax optimization?

A: Advisors ensure you are claiming all eligible deductions and incentives (like BOI tax holidays), help structure transactions efficiently, maintain proper transfer pricing documentation, and ensure full compliance to avoid penalties, ultimately minimizing your tax burden legally.

Q: What is the typical cost of engaging a business advisory firm in Thailand?

A: Costs vary significantly based on the scope of services, from one-time project fees for company setup to ongoing monthly retainers for accounting, payroll, and CFO services. Reputable firms provide transparent, upfront proposals after understanding your specific needs.

Q: Can an advisor help a foreigner open a corporate bank account in Thailand?

A: Yes, this is a common and crucial service. Banks have stringent documentation requirements. An advisor will prepare the necessary paperwork, accompany you to the bank, and leverage their relationships to facilitate a smoother account opening process.